The seller may accept this certificate and exempt the transaction from their state’s sales/use/transaction tax, but they aren’t required to accept it. However, Oregon does have a vehicle use tax that applies to new vehicles purchased in Oregon and a vehicle privilege tax that applies to new vehicles purchased by Oregon residents outside of the state. The tax must be paid before the vehicle can be titled and registered in Oregon.

How to calculate take home pay in Oregon?

The state of Oregon requires you to pay taxes if you’re a resident or nonresident that receives income from an Oregon source. Oregon assesses income tax at rates up to 9.9%, and doesn’t have a general sales tax. The Earned Income Tax Credit (EITC) is a significant tax credit in the United States, designed primarily to benefit working individuals and families with low to moderate income. As a refundable credit, the EITC not only reduces the amount of tax owed but can also result in a refund if the credit exceeds the taxpayer’s total tax liability. This makes the EITC a powerful tool for reducing poverty, incentivizing work, and providing financial support to those who need it most. The credit amount varies based on the taxpayer’s income, marital status, and number of qualifying children, with the intention https://www.bookstime.com/ of providing greater assistance to families with children.

Tax calculator

Part-year residents figure Oregon estimated tax the same way as a nonresident for the part of the year that they’re a nonresident, and the same way as a full-year resident for the part of the year that they’re a resident. Kotek created the Housing Accountability and Production Office this year and her oregon income tax proposed budget calls for $3.5 million to fully implement the office. Her budget requests for children and youth investments total more than $835 million. Oregon Transportation Commission chair Julie Brown also referred to the governor’s proposed budget as a significant investment. Kotek said her proposed budget builds on top priorities while “remaining disciplined” in creating new programs. See how much you can save when a TurboTax expert does your taxes, start to finish.

- SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you.

- This new W-4 now includes a five-step process that allows you to indicate any additional income or jobs, as well as other pertinent personal information.

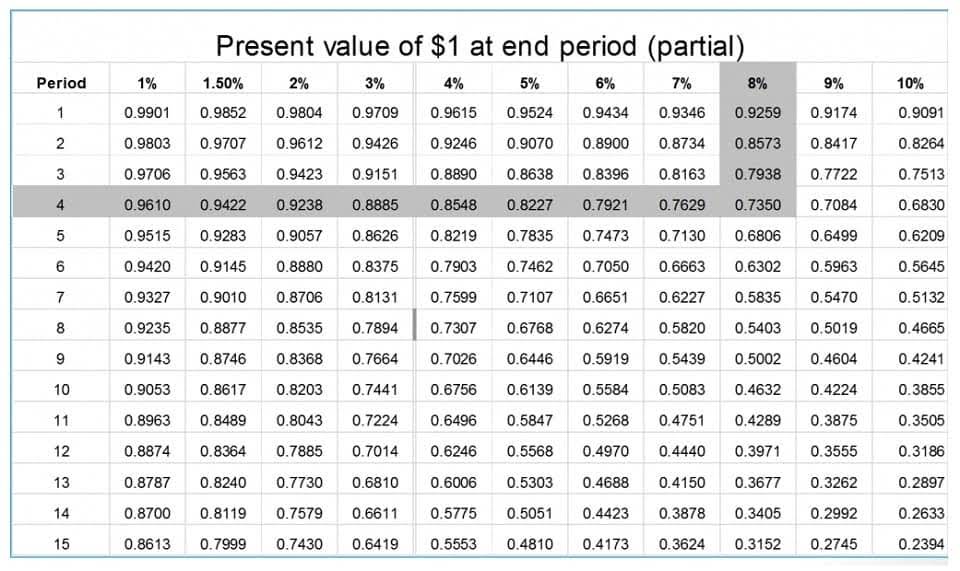

- When calculating your Oregon income tax, keep in mind that the Oregon state income tax brackets are only applied to your adjusted gross income (AGI) after you have made any qualifying deductions.

- To do this, simply file a new W-4 and write in the extra amount you’d like withheld.

- Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Live Assisted.

- Estimates suggest that a 10% universal tariff might bring in about $2 trillion over a decade, whereas a 20% tariff could raise approximately $3.3 trillion.

Related Calculators

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Statewide, the average effective property tax rate (annual property taxes as a percentage of home value) is 0.93%. Because of the inherently local nature of property tax collections in Oregon, rates vary significantly between counties.

- Income can come from a job, investments, a business, or retirement funds, and most of it is taxable.

- Tax credits are provided for political contributions, among other things.

- Though the Oregon legislature has disconnected from some of these, too often it has failed to act in the interest of the vast majority of Oregonians, letting tax breaks for the rich and corporations become part of Oregon law.

- Personal exemptions help reduce your taxable income, leading to a lower tax bill and more money in your pocket.

- Property subject to taxation includes all privately owned real property (land, buildings, and fixed machinery and equipment) and personal property used in a business.

Note that these are marginal rates, so they only apply to the portion of the estate falling within that bracket. Kotek’s recommended budget asks for $15.7 billion in total spending for education including a $600 million increase to the state school fund for a total of $11.36 billion. Kotek also is asking for the calculation to be “more accurate and predictable.” Oregon has a graduated state individual income tax ranging from 4.75% to 9.9%, according to the Tax Foundation. Whenever Congress creates new tax breaks, Oregon often ends up copying them automatically, without Oregon lawmakers having ever voted to approve them. The only way to stop these new tax breaks is for contra asset account the Oregon legislature to vote to reject them — to “disconnect” from them.

The standard deduction for a Head of Household Filer in Oregon for 2023 is $ 2,605.00. This site is a free public service not affiliated with the IRS or any governmental organization. The standard deduction for a Head of Household Filer in Oregon for 2024 is $ 2,745.00.