Understanding non-manufacturing costs is essential for effective budgeting and financial planning as they impact overall profitability and can influence pricing strategies. To help clarify which costs are included in these three categories, let’s look at a furniture company that specializes in building custom wood tables called Custom Furniture Company. Each table is unique and built to customer specifications for use in homes (coffee tables and dining room tables) and offices (boardroom and meeting room tables). The sales price of each table varies significantly, from $1,000 to more than $30,000.

Step #1: Calculate the cost of direct materials

For example, you can allocate depreciation costs of refrigerators to the department that uses them. As employees use Clockify to clock in and out, employers gain insights into the total number of hours each employee worked on each production line. You can also see the total number of hours worked by the entire team.

Examples of Nonmanufacturing Overhead Costs

Manufacturers can compare the costs of making a product using different manufacturing processes. This helps them understand the most efficient process and the investment they need to make for the selected process. A manufacturing company initially purchased individual components from different vendors and assembled them in-house. As the company decided to assemble the components themselves, they found that the costs of managing the assembly line and the transportation were increasing significantly.

Direct Manufacturing Overhead Costs

This is an estimate of the costs of carbon dioxide emissions, such as preventing, mitigating and recovering from climate-related natural disasters. As the manufacturing process involves raw materials and finished goods, all of these are considered assets. The materials that are yet to be assembled /processed and sold are considered work-in-process or work-in-progress (WIP) inventory. Another commonly used term for manufacturing costs is product costs, which also refer to the costs of manufacturing a product. Material costs are the costs of raw materials used in manufacturing the product. Calculating manufacturing costs helps assess whether producing the product is going to be profitable for the company given the existing pricing strategy.

Nonmanufacturing Overhead (Explanation Part

- It encompasses the costs that must be incurred so as to produce marketable inventory.

- The key takeaway of this case study is that understanding the fluctuations in manufacturing costs can empower companies to make informed and timely choices between outsourcing and in-house production.

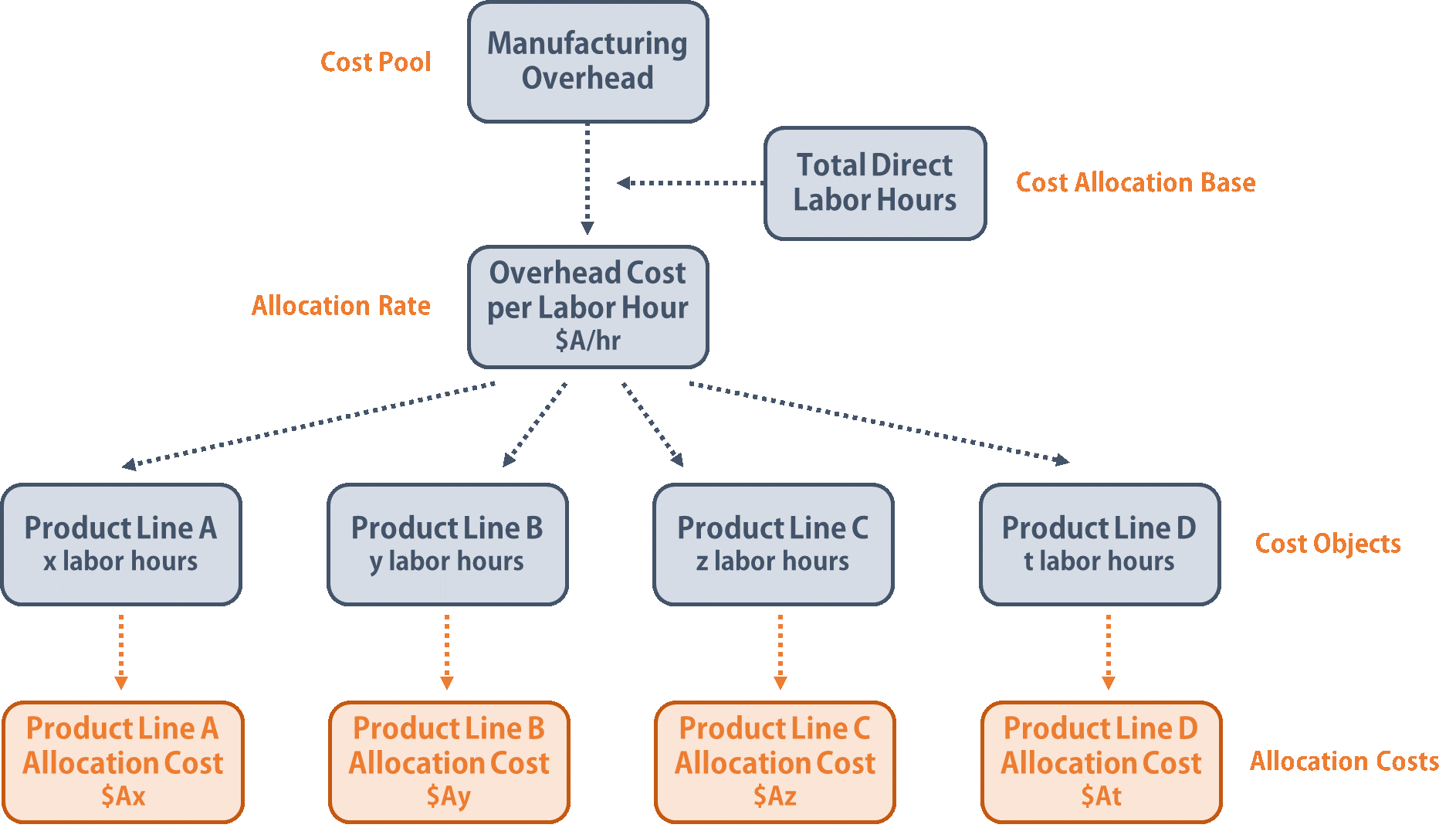

- Next, you will need to allocate the cost of the activities to the individual products.

- These include selling expenses (such as advertising costs, delivery expense, salaries and commission of salesmen) and administrative expenses (such as salaries of executives and legal expenses).

- Be sure to allocate overhead costs to the respective cost centers (specific departments, processes, or machines in the manufacturing facility that contribute to the manufacturing costs).

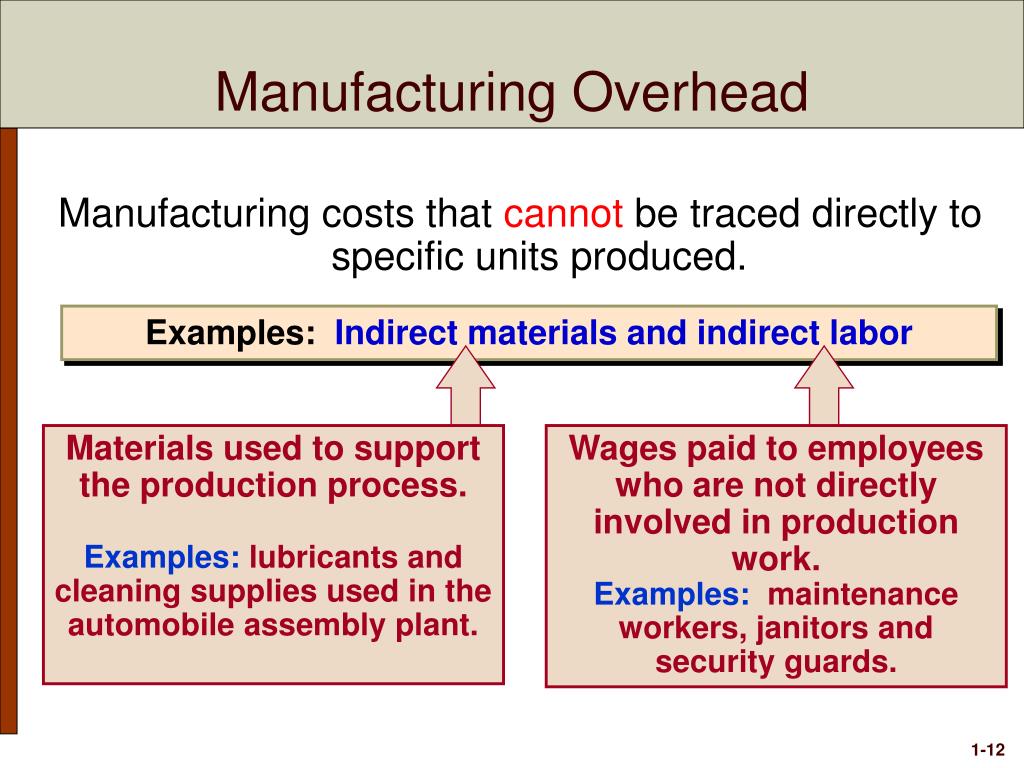

Small, inexpensive items like glue, nails, and masking tape are typically not included in direct materials because the cost of tracing these items to the product outweighs the benefit of having accurate cost data. These minor types of materials, often called supplies or indirect materials, are included in manufacturing overhead, which we define later. Manufacturing costs initially form part of product inventory and are expensed out as cost of goods sold only when the inventory is sold out. Non-manufacturing costs, on the other hand, never get included in inventory rather are expensed out immediately as incurred. This is why the manufacturing costs are often termed as product costs and non-manufacturing costs are often termed as period costs. Examples of direct materials for each boat include the hull, engine, transmission, carpet, gauges, seats, windshield, and swim platform.

Start by making a list of all the direct materials that are used to make the specific product and obtain the cost information for the direct materials you have identified. To calculate the cost of direct materials you need to know the cost of inventory. According to McKinsey’s research, cutting down manufacturing costs, in addition to boosting productivity, is the key for manufacturing companies to remain competitive.

Then, add up the cost of new inventory — this is the cost of raw materials you purchase to manufacture the product. The opportunity to achieve a lower per-item fixed cost motivates many businesses to continue expanding production up to total capacity. In fact, you already know that labor costs can spiral out of control if you don’t meticulously monitor them. A balance sheet is one of the financial statements that gives a view of the company’s financial position, while assets are the resources a company owns. These assets have value and the company can sell them to earn revenue.

Whether you’re just starting your own manufacturing business or are looking to venture into the field of cost accounting, understanding manufacturing costs and knowing how to accurately calculate them is crucial for success. A manufacturing entity incurs a plethora of costs while running its business. While manufacturing or production costs are the core costs for a manufacturing entity, the other costs are also just as important as they too affect overall profitability. Thus, management attention must be focused on both the core and the ancillary costs to control and manage them with a view to maximize profitability on long term basis.

In the end, management should know whether each product’s selling price is adequate to cover the product’s manufacturing costs, nonmanufacturing costs, and required profit. Manufacturing costs – incurred in the factory to convert raw materials into finished goods. It includes cost of raw materials used (direct materials), direct a r factoring definition why factor types of factoring labor, and factory overhead. On the other hand, a product with a low gross profit may actually be very profitable, if it uses only a minimal amount of administrative and selling expense. Direct labor manufacturing costs is determined by calculating the cost of employees directly responsible for producing the product.

While this is a simplified view of direct labor calculation, accountants also include the benefits, overtime pay, training costs, and payroll taxes when calculating the hourly rate. Mixed costs – costs that vary in total but not in proportion to changes in activity. It basically includes a fixed cost potion plus additional variable costs. An example would be electricity expense that consists of a fixed amount plus variable charges based on usage. Direct materials – cost of items that form an integral part of the finished product. Examples include wood in furniture, steel in automobile, water in bottled drink, fabric in shirt, etc.