Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration download the latest version of turbotax tax return app free in english on ccm filing. Appropriate records, methodologies and costs claimed will vary between sectors and projects. Revenue doesn’t have a strict line for what is a reasonable methodology; a company will pass the Accounting Test if the allocation method is “bona fide, reasonable, and based on the facts of the individual claim”.

Connect & Improve AccountingOptional

In accounting, decision-making is the process of choosing between two or more courses of action to achieve the desired outcome. Factors that should be considered when making decisions include the company’s financial position, Cash Flow, profitability, and business strategy. Accountants use the information to make decisions by analyzing data and trends to make informed decisions to help the company achieve its goals. When making decisions in accounting, it is essential to consider all relevant factors. Some of the factors that may be considered include the company’s financial position, Cash Flow, profitability, and business strategy.

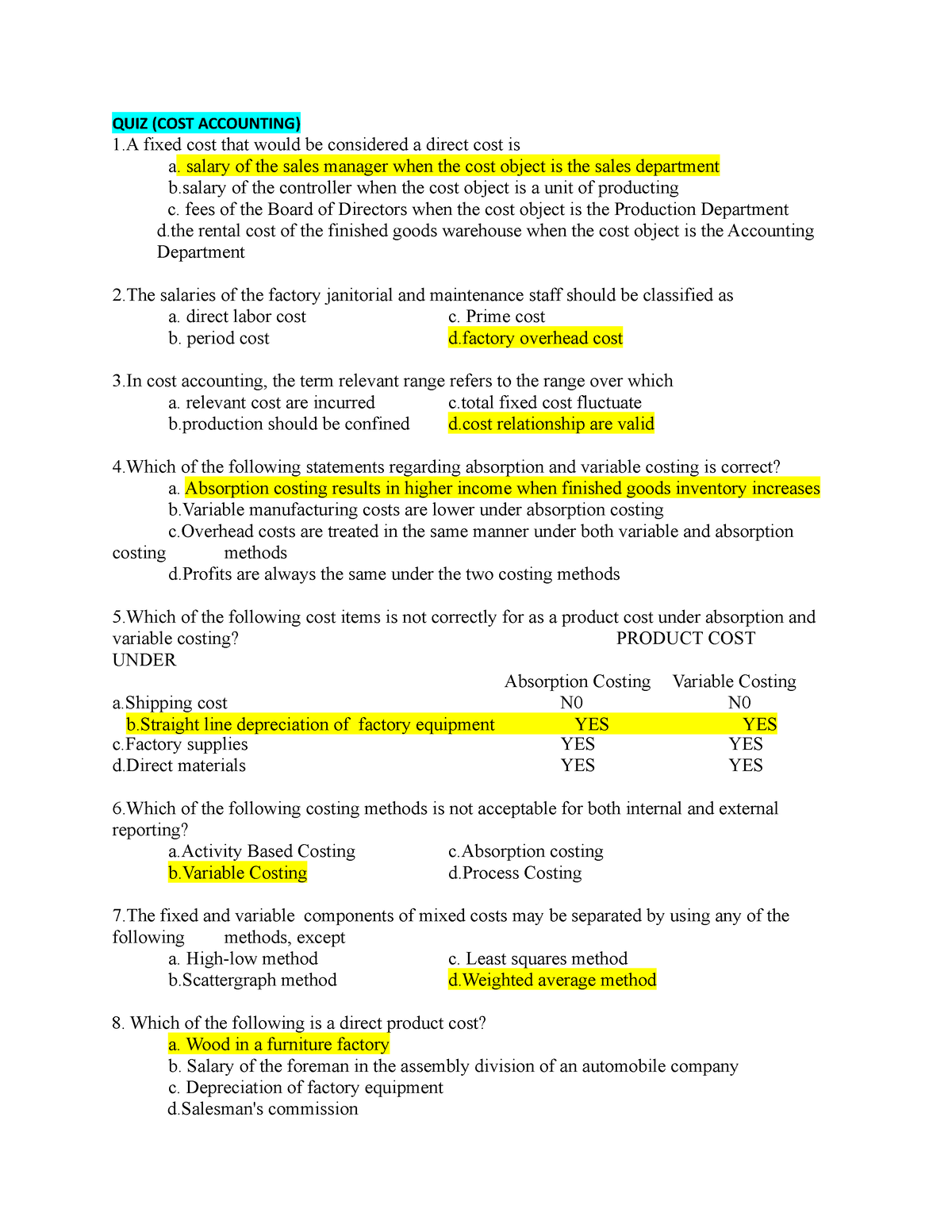

Accounting and Finance MCQs Test 1

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. If you wish to take an accounting quiz please do so by first choosing a quiz from the Popular Quiz list below.

Financial Statements Outline

Note that there is no time limit to answer the questions, and you can have as many goes at answering each question as you like. Why not try one of our accounting quizzes and test your knowledge of bookkeeping and accounting. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Common accounting decision-making models include the rational decision model, the incremental decision model, and the satisficing decision model. Each of these models has its own set of steps that should be followed when deciding. To begin the quiz, simply quick on the “Start Quiz” button below.

Cash Flow Statement

You can check your answers later through the link at the end of the quiz.

- However, it is crucial that some kind of systematic approach is implemented.

- We faced problems while connecting to the server or receiving data from the server.

- The owner’s equity account that contains the amount invested in the sole proprietorship by Mary Smith plus the net income since the company began minus the draws made by Mary Smith since the company began.

- By analyzing this data, accountants can make informed decisions to help the company achieve its goals.

Company

In the event of an R&D Aspect Query from Revenue, companies need to prove that they meet the Science Test and the Accounting Test. The former ensures that your R&D activities qualify under Revenue’s definition and the latter is to confirm that the costs have been correctly claimed. Both tests form part of an enquiry into an R&D tax claim and are conducted by Revenue’s experts. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. The owner’s equity account that contains the amount invested in the sole proprietorship by Mary Smith plus the net income since the company began minus the draws made by Mary Smith since the company began. The current year net income might be in the temporary revenue and expense accounts and the current year draws might be in the drawing account. However, after the financial statements for the year are prepared the current year net income and draws will be transferred to this account.

You can use these MCQs to help prepare for your exams, interviews, and professional qualifications. Receive instant access to our entire collection of premium materials, including our 1,800+ test questions. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. We faced problems while connecting to the server or receiving data from the server. The records should be contemporaneous (i.e., not filled in later) and reliable.

Of course, you only need to provide the records relevant to your costs. If you haven’t got any subcontractor payments, then you don’t need to provide evidence of this. Grant-funded companies must therefore retain all relevant records and ensure that they correctly claim for their R&D activities. Despite grant-funded small and micro-sized companies being exempt from the Science Test (provided they meet certain criteria), they must still pass the Accounting Test for the claim to be valid. The Accounting Test is part of how Revenue ensures that claims meet the qualification criteria. It’s a detailed examination into the costs claimed, performed by an expert from Revenue.